Previous reports

Past Predictions

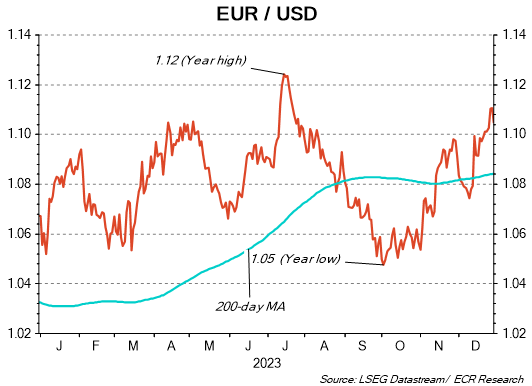

Readers frequently inquire about the accuracy of our predictions and whether we track them. Naturally, we don't possess a crystal ball, and the primary objective of our analyses is to present our readers with the most probable scenarios in the medium term. However, we do provide specific exchange rate predictions and in general they have been quite accurate.

Download our forecasts for EUR/USD and EUR/GBP for the period from January to December 2023 here below.